What is How2Invest?

How2Invest is an expansive and easy-to-use platform that is created to equip individuals with the information and resources needed to navigate through the complicated market of investing.

The platform is designed for both new investors looking for guidance as well as experienced traders who are looking for strategies that can be advanced, How2Invest serves as a virtual guide, providing valuable insight into the various investment options.

In contrast to conventional investment strategies which tend to be difficult to comprehend and can be overwhelming It reduces investment into easy and easily manageable steps.

What Kind of Details do How2Invest Give You?

You can think of it as your single-source shop for all things associated with investing.

How2Invest gives everything from beginners’ advice on topics such as the decentralized financial system (DeFi) as well as in-depth analysis of the landscape of investment.

The CFTC encourages investors to spend the time to fully know the businesses they are investing in rather than using only tips or suggestions from people.

In this way the investors are able to make educated decision based upon their own knowledge, thus reducing the possibility of making uninformed or reckless investment choices.

It acknowledges the importance spread investments across various industries and asset classes to limit risks. This lets investors take part in many growth opportunities, while also reducing the risk of any single investments.

Who Can Now Gain From How2Invest?

There is no one and anyone who would like to be in control of their financial situation.

The platform provides valuable information and techniques that can be tailored specifically to your goals regardless of whether you wish to build your savings, or prepare for retirement.

Aim of How2Invest

Understanding the goal and objective of How2Invest is essential to fully appreciate its power as a financial instrument.

This article will examine the fundamental goals that guide How2Invest and the reasons why it is important for investors just like you.

Empowering Financial Success

It empowers individuals to attain financial freedom through smart and educated investment decisions.

The company recognizes that each person has different financial objectives, be it you are planning to retire comfortably or financing a dream trip or just enhancing their fortune.

Guiding You Toward Growth

Do not abandon your financial plan in the hands of fate. Instead, it acts as a guide to help you navigate the complex investing environment.

It offers data-driven advice and bespoke strategies based on the specific goals of your financial plan.

Doubling Your Investment

One of the main objectives of How2Invest is a ambitious one: to increase the amount of money you put in.

Though this could sound intimidating however, the commitment is rooted in a thorough analysis of data and strategically-planned decision-making.

How2Invest looks for opportunities and takes care of risk to help maximize the potential of your portfolio’s growth.

Making Investing Accessible

Investment shouldn’t only be to financial professionals or wealthy elites.

How2Invest strives to bring investing into the mainstream by making it more accessible to everyone in all walks of life.

The easy-to-use interface and personalised approach guarantee that you’re able to confidently begin with your investments.

Determining the Right Goals

The financial goals you set for yourself are crucial to you, and How2Invest understands this.

When you’re seeking short-term gain or a longer-term increase in wealth They design investments that match with your goals.

This isn’t a universal method; instead, it’s crafted specifically for the needs of you.

Smooth Access to the Website:

This site ensures individuals can effortlessly access the details and navigate through the information available.

It aids people in being able to control their financial path. It provides a deeper knowledge of investing ideas.

Through these easy-to-use features, How2Invest site hopes to increase the financial health of its customers.

It provides a secure way to invest.

The uniqueness of this website is the fact that the team responsible for content created the content in a way that even novice investors will be able to comprehend the basics of investing.

An experienced investor will discover new ways for maximising his return.

How2Invest: Useful for Both Beginners & Experienced

No matter if a person has a good understanding of investing, or a less knowledge of the business the platform provides an array of helpful content to all.

When deciding to invest their hard-earned cash into any business, investors should think at least twice.

The website provides guidance and covers a variety of important subjects including retirement planning, as well as the reduction of risk.

A Special Place for In-Depth Discussion:

On How2Invest the site, you can find a column that provides in-depth discussion.

Questions like retirement planning, tax efficient expenditure, risk management and vitality of diversity are covered on this page.

Through educating the public about the subject matter, it aids people in increasing their knowledge on a broad range of subjects.

It gives helpful and insightful suggestions to users, to enable them have access to all the tools they require.

A well-informed decision can help users align the goals of their finances and create a strong financial basis.

What are the Main Features and Advantages of How2Invest?

How2Invest provides a variety of features and benefits, making it a desirable choice for investors. There are a few benefits:

A user-friendly interface How2Invest offers a simple and easy-to-use interface which allows users to use and navigate investment.

Users are able to easily find ETFs, stocks, and mutual funds using the name the symbol, name, or.

They can also look up the details of every investment choice like prices as well as performance, dividend yield expenses ratio, risk score as well as other information.

You can also personalize your portfolio by adding or eliminating the investments they have, changing the allocation of their portfolio, or creating automatic deposit options.

Cost-Effective: How2Invest charges a flat price of 0.25 percent per year for investments that is less than traditional platforms, which cost high charges to manage accounts and transactions. The result is that investors will lower their costs on the long-term by investing in How2Invest.

Variety of Options for Investing: How2Invest offers a wide selection of investment options which include ETFs, stocks as well as mutual funds.

You can pick from more than 3000 stocks across various categories and fields, as well as over 500 ETFs in various types and topics, as well as more than 1,000 mutual funds that are part of various funds and fund strategies.

They are also able to diversify their portfolios through investing in various types of assets, regions and segments.

Educational Sources: How2Invest provides a wealth of resources for education to aid users to understand more about investing.

The users can find video, articles as well as webinars on the basics of investing and investing strategies, market trends and financial planning.

Participants can also take tests as well as tests to assess their skills and knowledge.

Instruments for Monitoring and Analyzing Investment Performance: How2Invest provides users with instruments for monitoring and analysing their investment portfolios.

The users can see their portfolio’s results, balance as well as allocations, returns and more.

They can also evaluate their portfolio with different benchmarks and indexes.

The users can also make use of instruments like charts, graphs and calculators as well as. in order to visualise their information and make educated decision-making.

Different Types of Investments

There are many forms of investment that each have their specific risk and return factors.

It’s important to be aware of the diverse types of investments that are available for you to make educated decisions that are compatible with your goals for financial success and your risk tolerance.

Stocks: The stock market is a representation of ownership of a business and provide an opportunity for capital appreciation.

If you purchase shares of a stock company as a shareholder, you are a fractional owner, and you stand to profit from the firm’s successes.

Stocks are able to provide longer-term as well as short-term gains However, they come with greater risks compared to other options for investing.

Bonds: These are instruments of debt that are issued by government or companies. When you purchase bonds, you’re borrowing money from the issuer for regular monthly interest payments for an agreed-upon period.

The majority of people consider bonds to be more secure than stocks, and offer a steady income which makes them appealing to people who want to earn income.

Real Estate: Investments in real estate involve the purchase of properties which could provide rental income or grow in value with time.

Real estate is a great source of cash flow and capital appreciation and is a preferred choice for investors who want in diversifying their portfolio. But, investments in real estate need careful planning and research.

Mutual Fonds: Mutual fund pools the funds of multiple investors in order for investment in a diversified portfolio that includes bonds, stocks or any other asset.

They are overseen by expert fund managers who take the investing decisions on behalf of customers.

Mutual funds provide diversification and can be a good choice for those who are more relaxed when it comes when it comes to investing.

ETFs (ETFs): ETFs operate similarly to mutual funds however they behave just like stocks that trade on a stock exchange.

ETFs provide investors with an exposure to a certain industry, market index or even an asset class.

ETFs provide flexibility and the ability to sell and buy shares during trading hours.

Alternative Investments: In addition to the traditional options for investing alternatives include alternative investments like hedge funds, commodities as well as private equity.

They are generally greater risk, but also potentially better return. Commodities comprise physical assets such as oil, gold or agricultural goods.

Hedge funds are instruments for investing that pool funds of high-net-worth people and institutional investors, to use a variety of investment strategies.

Private equity is investing in private-owned businesses or in assets which aren’t publicly traded.

It is vital to keep in mind that every investment has its own unique risk and reward.

Before making a decision, it’s recommended to speak with a financial professional or conduct thorough research to fully understand the dangers, the potential returns and the appropriateness of each choice for your particular needs.

How2Invest vs. Traditional Investment Platforms

In comparing How2Invest with traditional platforms for investing, a number of distinct differences are revealed that enhance the overall experience for investors.

Most importantly, How2Invest distinguishes itself by making sure that its users are comfortable and accessible.

In contrast to traditional investment platforms, which can be difficult for novice investors because of their complexity and complicated user-friendly navigation.

How2Invest has a straightforward and easy-to-use interface.

Its design allows investors regardless of degree, to invest and navigate through the platform.

Alongside its easy-to-use strategy, How2Invest sets itself apart by its efficient pricing structure.

In addition, as mentioned previously that the company offers a flat rate of 0.25 percent per year for the assets it invests in, which is significantly less than those charged by conventional investing platforms.

This makes it possible for investors to maximize their profits with a lower cost for charges, which makes How2Invest a great option for investors looking to maximise their investment opportunities.

Additionally, the company’s dedication to financial education is an important advantage over traditional platforms for investing.

While other platforms provide some education resources, How2Invest places a premium in promoting knowledge of investors and the empowerment of investors.

In the end, these important differences create How2Invest an appealing and comprehensive choice for investors of all experiences.

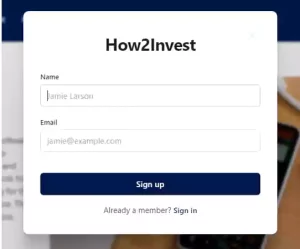

How2Invest Account Setup Process

The account setup process at How2Invest is easy and fast. Follow a couple of easy steps to get started.

- The first step is to visit the How2Invest website, and then click on”Sign Up” from the “Sign Up” option.

- Your email address, name along with your password are the most important details that you’ll have to submit next.

Then, you’ll receive an email requesting you sign up for the account. A short questionnaire regarding the goals you have for investing and the level of comfort you have with risk is in the.

This helps How2Invest in providing you with the best investments.

Not least of all, it is essential to link your account with your bank to the How2Invest account.

It is possible to start investing immediately after making the transfer.

This is as simple as that! It’s time for the first time to use How2Invest in order to make investments.

How2Invest Investment Options

How2Invest provides a range of possibilities for where you could invest your money and is considered to be one of its greatest features I believe.

You are able to put your money into the individual stocks of a variety of domestic and foreign companies.

There are also ETFs and mutual funds, that are ideal for investors seeking diversify the portfolio of the money they have.

There’s more, too! Making smart investment decisions can be easy thanks to the resources and tools provided by How2Invest gives.

It is easy to check immediately how your investments are doing because they can access in live market information and data.

In addition, they offer educational instruments to help improve the understanding of your investments and help with making more informed financial choices.

You can choose from a wide range of choices when you invest with How2Invest, to properly grow your wealth.

How2Invest Pricing and Fees

The extremely low cost of How2Invest is one of the best things about it that I’ve already mentioned.

It charges only a tiny portion of 0.25 percent per year for the funds you put in which is much lower than the other platforms for investing.

Additionally, How2Invest imposes a modest charge for some specific products. When you trade for individual ETFs or stocks They charge $4.95.

Even with these extra charges, they’re still cheaper than other trading platforms.

Overall, I think the How2Invest platform is great for investors who want to cut costs. It’s perfect for investors seeking to boost the growth of their finances while also reducing expenses.

How2Invest Security Measures

Security is an important concern in investing. But, How2Invest is fortunate because they take security very seriously, and employs a number of solid security measures to protect user accounts as well as funds.

In the first place, they safeguard your financial and personal information by using a highly secure encryption system similar to banks.

In addition, they ensure customers set up two-factor authentication to provide an extra measure of security.

Additionally, How2Invest monitors accounts for suspicious behavior, and informs customers if something is not right.

Furthermore they’re bound by SEC regulation that imposes further guidelines and controls to protect the users.

Overall, the security measures taken by How2Invest really amaze me. Being confident that my investment is safe through the platform gives me peace of mind.

Conclusion

There you go an extensive guide to How2Invest as well as your best strategy to make smart investments!

The guide covers everything from the basics of investing through How2Invest to understanding the complicated financial environment.

If you follow the KISS principle and making use of the abundance of information offered by How2Invest to help you make well-informed decisions that are in line with your financial objectives.

Be aware that investing isn’t an individual-sizing strategy.

Knowing your tolerance to risk, your timeline, and financial goals is crucial prior to investing in any option.

With How2Invest as a trusted source to guide you through the area of decentralized financial services (DeFi) Mutual funds and.

ETFs and tax law as well as regulations.

What are you wasting time to do? Begin exploring everything How2Invest offers now and begin your way to smart investment.