There are a variety of loans available on the market, and it can be difficult to know which one is right for you. In this blog post, we will discuss the four types of loans that you should know about if you are looking to make a necessary purchase.

These loans include the payday advance app, the payday loans app, the personal loan, and the home equity loan.

We will go over each one in detail and help you decide which one is right for you!

A Variety of Financing Alternatives

In today’s economy, it’s more important than ever to be mindful of your finances. When it comes time to make a necessary purchase, there are a variety of financing alternatives available.

One option is to pay cash upfront. This is often the most economical choice, as you will avoid paying interest.

Another option is to finance the purchase through a traditional lender such as a bank or credit union.

This can be a good choice if you have good credit and can qualify for a low-interest rate.

Another option is to use a personal loan from an online lender. This can be a good choice if you have bad credit and cannot qualify for a traditional loan.

There are also many store credit cards that offer promotional financing, which can be a good choice if you plan to pay off the balance within the promotional period.

Ultimately, there is no one-size-fits-all solution when it comes to financing a purchase, so it’s important to compare your options and choose the option that best meets your needs.

Personal Loans

A personal loan is a type of loan that can be used for a variety of purposes. Personal loans typically have lower interest rates than credit cards and payday loans, and they may have longer repayment terms.

However, it is important to carefully consider all of your options before taking out a personal loan, as you will be responsible for repaying the entire loan amount plus interest.

According to the Federal Reserve, there are presently 21.1 million personal loans in the United States that have not been paid back.

This figure does not include mortgages, auto loans, or other types of debt.

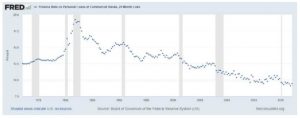

The average personal loan size is $16,259, and the average interest rate is 10.22%.

There are several reasons why people take out personal loans, including consolidating debt, paying for emergency expenses, or financing a large purchase.

Personal loans can be a helpful way to manage financial obligations, but it is important to understand the risks before taking out a loan.

For example, missed payments can damage your credit score, and adding more debt may make it difficult to meet your financial goals. Before taking out a personal loan, be sure to carefully consider your needs and options.

General-Purpose Lenders

There are a number of general-purpose lenders that offer loans to consumers.

These lenders include banks, credit unions, and online lenders. Banks and credit unions typically offer personal loans, while online lenders may offer both personal loans and payday loans.

When considering a personal loan from a bank or credit union, it is important to compare the interest rates and fees of several different lenders. It is also important to shop around for an online lender, as the interest rates and fees can vary significantly.

Peer-to-Peer Lending

Peer-to-peer lending is another option that has become increasingly popular in recent years. With peer-to-peer lending, you can borrow money from a group of investors.

The interest rates on peer-to-peer loans are typically lower than the rates offered by traditional lenders.

In addition, the application process is often shorter and simpler.

However, it is important to note that not all peer-to-peer lenders are created equal. Some platforms may have higher interest rates and fees than others.

Payday Advance App

A payday advance app is a type of loan that allows you to borrow against your next paycheck.

These loans are typically small, short-term loans that must be repaid within a few weeks.

Payday advance apps typically have high-interest rates, so it is important to only borrow what you need and to be sure that you can repay the loan on time.

Payday Loans App

A payday loans app is similar to a payday advance app, but these loans are typically larger and have longer repayment terms. Payday loan apps can be helpful if you need a larger amount of money and have a longer time to repay the loan. However, these loans also typically have high-interest rates, so it is important to only borrow what you need and to be sure that you can repay the loan on time.

Credit Cards

Credit cards are a convenient way to make purchases, and most cards offer some form of rewards or cashback program. In addition, many credit cards offer 0% APR for a period of time, which can be helpful if you need to finance a large purchase. However, it is important to note that credit cards typically have high-interest rates. Therefore, it is important to only borrow what you need and to be sure that you can repay the loan on time.

A 401(k) Plan Loan

If you have a 401(k) plan, you may be able to borrow against your account. 401(k) loans typically have low-interest rates and flexible repayment terms. However, it is important to note that if you leave your job, you will typically need to repay the loan within 60 days. In addition, if you are unable to repay the loan, the amount that you borrowed will be considered a withdrawal and will be subject to taxes and penalties.

Home Equity Loan

A home equity loan is a type of loan that allows you to borrow against the equity in your home. Home equity loans typically have lower interest rates than personal loans and credit cards, and the interest may be tax-deductible. However, it is important to carefully consider all of your options before taking out a home equity loan, as you may be putting your home at risk if you are unable to repay the loan.

Which Loan Is Right for You?

Now that you know more about the different types of loans available, you can start to compare your options and decide which one is right for you.

If you need a small amount of money for a short period of time, a payday advance app or payday loans app may be a good option.

If you need a larger amount of money for a longer period of time, a personal loan or home equity loan may be a better option.

Be sure to compare interest rates and fees, as well as repayment terms, before making a decision, and remember, it is important to only borrow what you need and to be sure that you can repay the loan on time.