Thousands of people were laid off or experienced job insecurity over the past few years. With the loss of monthly income and financial uncertainty, we all need a helping hand with our personal finances. That makes the site provides speedy loans or PayDay Say loan apps very popular these days. More and more people are looking for ways to adjust their budgets during the economic recession.

If you find it challenging to manage your money and switch your focus toward budgeting, you need professional advice. Here is what you can do to keep your funds afloat during tough times until the circumstances change for the best.

The Importance of Budgeting

Some people don’t think budgeting is essential or can really make a difference especially when they feel strapped for funds. Lots of people have temporarily lost their positions during the pandemic. However, there is no need to postpone your financial planning even if you don’t have a steady income source at the moment.

It’s obvious that you might not feel secure in terms of finance today. Budgeting can become a helpful tool for keeping track of your personal finances. It is important especially if you have some monetary goals. The only way to change financial uncertainty into an opportunity for growth is to change your attitude and adjust your monthly budget.

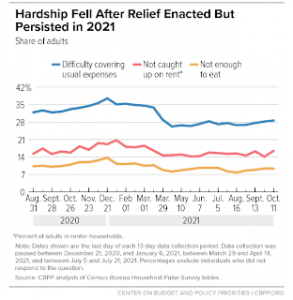

According to the recent report on Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships released by the Center on Budget and Policy Priorities, the unemployment rate jumped in April 2020 to a level not seen since the 1930s – and stood at 4.9 percent in October 2021.

There were still 4.2 million fewer jobs in October 2021 than in February 2020. The growing stress and uncertainty about the future make people seek additional ways of approaching financial planning. Keep on reading to find out the best ways to budget for the unknown and make the right financial decisions.

Set Or Revise Your Monthly Budget

First of all, you need to go back to the basics. Nobody can be certain about the future, especially in the modern world. Here is why you can actually benefit from this uncertainty by starting to budget or revising your existing monthly budget to adjust your personal finances to new circumstances. Budgeting is essential as it’s the very first option to keep track of your finances and control your spending.

If you have already established a budget, you still need to revise it and check if something may be altered. Divide your budget into spending categories and check if you can cut down some expenses to find new opportunities to save more funds. Review the spending limits you are having now.

Find a Side Gig

Supplementing your earnings and boosting your income potential is another helpful solution during challenging times. Whether you are worried about losing your position or you have temporarily been laid off, getting a side gig may help you prevent financial disruptions. This is a suitable solution for every person who needs to strengthen their savings account or emergency fund or wants to diversify their income options.

You may look for job openings on a variety of websites and online platforms. Some people choose to freelance, while others rent out spare rooms or become Uber drivers. But it’s also a good time to try out different trending ways of getting additional money, for example, a payday loan affiliate network.

If you have a website you may make some cash by joining this affiliate network and getting paid each time someone clicks through from the site to the partner website and makes a purchase.

Get Your Credit Rating in Good Shape

A common mistake is to start thinking about your credit rating when you urgently need additional funds. Your credit score will most likely suffer and it will be harder to qualify for loans or credit cards if you don’t get your rating in good shape.

So, it’s beneficial to consider boosting your credit in advance. This way you won’t have trouble with your creditworthiness and you will be able to get approved for different lending solutions at the best rates.

Automate Your Bill Payments

Are you willing to get some help with financial protection? One of the best ways to do it is to automate your bill payments. It will also protect your credit and make sure your scheduled payments are conducted on time. You will be able to avoid late charges and penalties. This is especially relevant for borrowing solutions as failing to make regular loans or credit card payments may lead to credit damage.

It takes just a few minutes to set up such automatic payments and this process can be performed online. Make certain you revise all the loan payments, utility bills, and credit cards you have and automate these payments as soon as possible.

Keep Saving

One of the most significant tips is to continue saving. You need to set a portion of your monthly income aside and never forget about it. Remember about your emergency fund and always keep some funds on it for unforeseen expenses.

This is your fund for the rainy day so if you happened to withdraw some cash from it make sure to put it back from the next paycheck. Also, keep on saving for your retirement. Consider choosing a high-interest savings account to earn the best rates on your savings and maximize them.

Conclusion

If you don’t feel financially secure or want to adjust your budget, you need to take immediate action. Don’t wait until negative obstacles take advantage of you. The economic recession and financial uncertainty may unsettle those who are not prepared.

Follow our professional tips or talk to a financial planner to review your present situation with personal finances, make the necessary adjustments to your monthly budget, and help you plan for the future even during uncertain times.