AI and cryptocurrency trading are expanding rapidly with potential to revolutionize the field of finance. As technology improves in the area, it’s becoming clear that artificial intelligence will continue to play a major role in determining the direction of commerce. In this article, we’ll take a explore the basics of AI and crypto trading, and the convergence between both areas, along with the pros and disadvantages of the use of AI when trading using cryptocurrency. Then we’ll look at the next steps in AI along with trading in cryptocurrency.

Understanding the Basics of AI and Cryptocurrency Trading

Before getting into the details, it is important to learn about AI and cryptocurrency trading. Artificial intelligence refers to the development of machines that can carry those tasks which typically require human intelligence. Cryptocurrency trading, however, is the purchasing selling, and the exchange of digital currencies through websites.

Now let’s look at the role of AI in today’s market of trading, and also its growth in the crypto market.

The Role of AI in Modern Trading

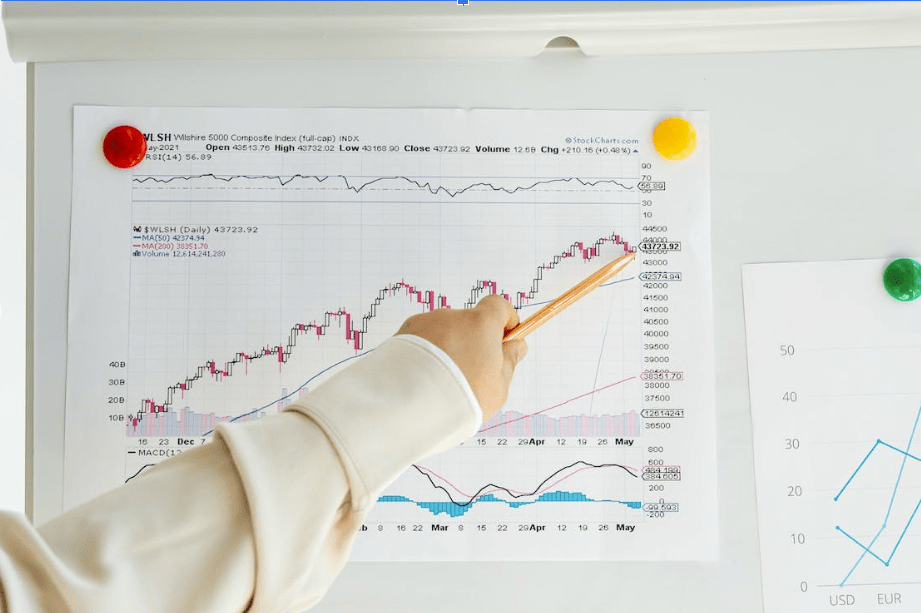

In the past few decades, AI has been a important element in modern trading strategies. Thanks to its capability to process large amounts of information and identify patterns that emerge, AI algorithms can analyze the market and anticipate the future with astounding accuracy. It also gives traders the chance to make money from trends in the market and to make educated decisions.

In addition, AI-powered trading platforms are constantly improving and adapting to changes in the market, allowing the development of more effective and efficient strategies for trading. Automating repetitive tasks and reducing human error, AI will greatly improve the speed and efficiency of trading operations.

A good example of AI used in trading during the present day is in the use of machine learning algorithms that analyse historical market data in order to find patterns that may indicate the future changes in price. The algorithms consider different elements, such as the market’s mood in addition to news and technical indicators to create trading signals. Investors can use these signals to trade, and make investments.

In addition, AI can also be used to reduce risk when trading in cryptocurrency. By analyzing information about market trends as well as performance over time AI algorithms are able to identify potential risk and recommend ways to minimize the risk. This can help traders with the reduction of losses and protect their investment.

The Evolution of Cryptocurrency in the Financial Market

It’s been a long step forward since it first became a reality. In the beginning, it was considered a vague concept, however cryptocurrency such as Bitcoin as well as Ethereum are now widely accepted and are now component of the global financial system. Their growth in popularity has been associated with an increase in trading and is attracting the most experienced investors as well as novices to the market for financial services.

In light of the growing popularity of cryptocurrency, and the increasing demand for advanced trading tools and methods is becoming evident. It’s the place the place where AI is in a position to assist with its unbeatable capability of analysing the market, identifying patterns and trades that are not involving humans.

Furthermore it is the decentralized nature of cryptocurrencies is what makes them a desirable alternative to individuals and businesses looking for alternatives to traditional methods of payment.

The market for cryptocurrency is quick as well as secure, which eliminates any need for intermediaries, such as banks. It is the result that there is more usage of cryptocurrency across various areas such as e-commerce cash transfer or even donations to charities.

Furthermore, the technology which is the basis of cryptocurrency could revolutionize many aspects which go far beyond financial services. Because it’s impervious and transparent, it’s suitable for various applications like the management of supply chains, voting systems and intellectual security for property rights.

As the cryptocurrency market is growing, AI will likely play increasing roles in the development of strategies to trade along with market developments. Due to its ability to analyze huge amounts of data and adapt to changes in the market, AI can help traders navigate the complexities of the cryptocurrency market and take better decisions.

The Intersection of AI and Cryptocurrency

When we’ve laid the groundwork then we’re able to start looking at how AI transforms the field of trading in crypto, and the potential it might be bringing in the near future.

As the relationship between AI and trade is increasing, Quantum AI emerges as the leading contender for the next technology advancements in cryptocurrency. Combining the never-ending computational capability of quantum mechanics as well as advanced algorithms to predict study of artificial intelligence(AI) and its applications, this method can revolutionize the way we view and interact with cryptocurrency.

Due to the inherent complex and volatility that’s present in the market for cryptocurrency, Quantum AI is a revolutionary lens for traders that provides greater understanding as well as faster transactions capabilities, and more accuracy in forecasting trends in the market. As we think about the future of cryptocurrency and blockchain technologies We can conclude that the possibility it will be Quantum AI will be an integral part of the web of technology.

How AI is Changing Cryptocurrency Trading

AI is changing the process through which cryptocurrency trading can be carried out. Traditional approaches to trading are based on emotions of humans which can lead to ill-informed choices and lost opportunities. AI algorithms aren’t affected by emotions and make decision-making on information that’s independent and algorithmic.

With the help of historical price data, along with market indicators and data analysis on sentiment and news events, AI recognize patterns and predict price fluctuations far better than human. This can result in greater profits and lower chance of loss when it comes to cryptocurrency trading.

The Potential of AI in Predicting Cryptocurrency Market Trends

One area where AI excels in is its ability to anticipate market trends. When it comes to analyzing massive amounts of information in real-time, AI algorithms can identify patterns and connections that traders could be unable to see. AI-powered trading systems can be adept at responding rapidly to any changes that occur on the market and to make quick trade-making choices.

Furthermore, AI can factor in several variables at the same time and give a greater understanding of the market’s developments. Deep learning provides AI an advantage over other strategies for trading since it is able to identify new possibilities and reacts instantly.

The Benefits and Challenges of AI in Cryptocurrency Trading

While AI can be a fantastic alternative to trading with cryptocurrency but it’s not without negatives. Consider both the advantages and disadvantages prior to investing in fully-AI-powered trading platforms.

The Advantages of Using AI in Cryptocurrency Trading

One of the major advantages of AI for cryptocurrency trading is its ability to analyze huge quantities of data simultaneously. This allows for faster and more accurate decisions which leads to increased effectiveness as well as increased profits.

Additionally the AI-powered trading platforms operate throughout the day, which is essential to an industry that is constantly awake. That means there’s no requirement for those that are humans to keep track of the market on a continuous basis and make certain that there aren’t any chances to trade that go unnoticed.

The Risks and Limitations of AI in Cryptocurrency Trading

Yet, despite its promises AI could be a major chance for cryptocurrency trading. is not without risk. One of the greatest concerns is that of being too adapted. If this happens it is possible that the AI algorithm can become too sophisticated and is unable to function with changing market conditions.

Furthermore, the use of data from the past for AI models means that sudden shifts in the market or events that occur suddenly can cause inaccurate prediction. It’s essential to continually review and refine AI algorithms to be able to adapt to the ever-changing dynamics of the markets.

The Future of AI and Cryptocurrency Trading

In the same way that AI advances with each advancement technology, the future of cryptocurrency trading appears more and more promising. This article will review some of the forecasts we’ve made about AI as well as crypto trading and the things traders need to do in order to prepare for the future.

Predictions for AI and Cryptocurrency Trading

In the next few years it will be possible to witness a steady increase in AI technology. This can result in more sophisticated trading strategies that will also provide more accurate predictions. AI-powered trading platforms are going to become increasingly commonplace and offer investors, both individuals and institutional investors the chance to optimize their trading strategies.

Furthermore, the combination of AI and blockchain technology offers enormous potential to enhance the security and efficiency of trading in cryptocurrency. Smart contracts and exchanges that are decentralized which are powered by AI algorithms can change how transactions are carried out and completed.

Preparing for the Future: AI and Cryptocurrency Trading

To be prepared for the future of AI and cryptocurrency trading, traders must be informed of new advancements and adapt to them. Becoming up-to-date on the most recent advancements regarding AI technology and being aware of the effect it will have on the financial market services is crucial to stay active in the market.

Furthermore, traders need to be cautious and conduct thorough study prior to using AI-powered trading platforms. Knowing the risks and limitations of AI algorithms could help traders in making informed choices and minimize the possibility of losses.

Conclusion

For a conclusion, AI and cryptocurrency trading will impact how we perceive the financial services market. Integrating AI algorithms with trading platforms for cryptocurrency provides unimaginable possibilities for traders to improve their strategy and profit margins.

It is vital to stay conscious of the dangers and limitations associated with AI when trading with cryptocurrency. Constant monitoring, adjustments and knowledge of AI algorithms are essential to ensure exact forecasts, and also to lower the risk.

The next few years will see us making the most of the opportunities that are offered by AI as well as cryptocurrency trading being alert and adaptable is essential to succeed in the ever-changing market.