Activatewisely.Com Activate Card with Simple Steps : Easy Solution

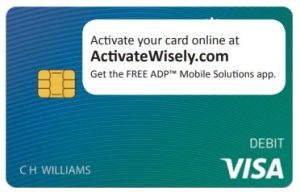

Activatewisely.Com Activate Card: ADP is one of the top payroll providers within the United States and provides Wisely Card. It is a Wisely Card is a prepaid debit card that allows customers to receive their pay or government benefits as well as tax refunds with minimal hassle.

It is more secure to carry cash since it is able to be used anywhere where there is a payment system that accepts Visa debit cards.

The Wisely Card has to be activated prior to the card can be used. It is possible to activate the card through the web. If you’re a first-time customer with this Wisely Card and can’t seem to figure out how to activate it then you’re on the right track.

This article will explain how to activate the Wisely Card online through Activatewisely.com. Therefore, with no further delays, let’s get started.

Prerequisites

Before we go into the process of activating the Wisely Card online with (Activatewisely.Com Activate Card), you should ensure that you’ve got everything you need. If you’re unsure about what to do, here are the items you’ll need to do in order to activate your Wisely card:

- The Wisely Card Information: To activate your Wisely Card on the internet, you need to be able to access it and ready to give the card’s 16-digit code and expiration date.

- Personal Details: You’ll need to supply information such as the address you live in, your Social Security number, your full name as well as your date of birth. It is necessary to provide these details in order to verify your identity and allow you to use your card.

- An Email Address Valid and Phone Number It is required to have an active email address in order for registration and a valid phone number for verification of your authenticity. When your card is activated, you will get an email confirmation.

- Internet connection and Internet connection and a Browser: To activate your Wisely Card on the Internet, you need to possess a stable and reliable Internet connection. In order to ensure that your private information is safe It is recommended to connect to a safe and secure internet connection. Every web browser can be used to allow you to access your Wisely Card online.

Activate Wisely Card Online

As we mentioned the activation of Wisely Card to use its services is crucial. It is possible to activate the Wisely card by activating it on the activatewisely.com website. The steps to activate the process:

- Use your preferred browser and navigate to the official site for activation of the Wisely Card. activatewisely.com.

- Input your card’s 16-digit number in the activation page which is followed by the date of expiration within the fields that are provided.

- Do your “I’m not a robot” test to verify that you’re a genuine user of the.

- Input your personal details like your full name, birth date, Social Security number, as well as your address. Check that the information you entered is accurate and correct. If you find any mistakes it is possible to amend your information to correct it.

- Make your own 4-digit PIN for transactions that you can authorize with the Wisely Card. If asked, enter your desired PIN.

- Hit the Continue button to finish the activation process. When the activation procedure is done, you will receive an email confirmation that confirms you have activated your Wisely Card is active and ready to utilize.

- Congratulations! You’ve been able to activate your Wisely Card on the Internet. Now you can make use of your Wisely Card to purchase items or cash out at any ATM that accepts Visa debit cards.

What Are The Benefits of a Wisely Card?

- This card will receive direct bank transfers at no cost.

- The embedded EMV chip helps prevent theft and fraud.

- The fees associated with overdrafts aren’t charged or imposed, and a minimum amount of balances is not needed.

- There are over 100,000 points where you can withdraw cash.

- By using a cashier’s check or credit card you will be able to make payments or shop on the internet, then buy anything you like.

- The card can be used in conjunction using MasterCard debit cards.

- Users can avail of the services provided by government agencies, by simply depositing their money.

- Earn cashback reward points or referral bonus points and you can get a discount on your purchases.

- Utilizing your phone to verify the balance on your Wisely credit card.

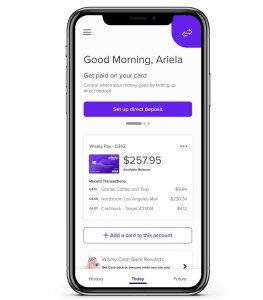

How To Use Your Wisely Card on myWisely App

In-Store Purchases

It is possible to use the card everywhere Visa is accepted. This includes restaurant chains, grocery stores gas stations, restaurants, and retail stores, after activating your card wisely.com.

Use as Signature or Debit

- Signature Transactions: Utilizing the card with no PIN is the most effective method of using it. There are no fees related to these transactions.

- PIN/Debit Transactions: This is a type of PIN transaction which are ideal for businesses that want to offer you cash in return. There’s no cost for these transactions.

ATM Transactions

It is possible to withdraw cash from ATMs all over the world. Go to myWisely.com to locate nearby, charge-free ATMs. You can also download the free myWisely mobile application.

How Do I Activate My Wisely Pay Card on Activatewisely.com

- Log in to your Wise account using either the app or the website.

- When you are on the website, select the Debit card tab. Your account can be accessed via the Account section of the application.

- Select Activate your card.

- You must enter your six-digit Code beneath your initials on the card.

For US cardholders

When you’re staying in the US it is necessary to activate the American credit card you have through Wisely.com. In order to activate your card take these instructions.

- Visit your Wise account.

- On the website, select Debit card. When you’re on the application you can tap Account.

- Select Activate your card.

- On your card, you’ll find a 6-digit code below your name.

- Set your PIN.

How Do I Activate And Login My Wisely Direct Card

Visit the official Wisely website, https://www.activatewisely.com, or give 1-866-313-9029 a call to activate your direct card on wisely.com. The next step is to choose the PIN (Personal Identification Number) to ensure that you’re Wiselycard is activated.

Do you want to learn what Wisely Pay functions for mobile phones, and also how to log in? You can follow these steps. For a transfer then, sign in to your account using your smartphone.

- For a start, register your card on activatewisely.com or install the myWisely application.

- Once you have downloaded the application it is possible to control your account by checking the balance.

- Then you can upgrade your credit card in order to access the accounts with premium capabilities.

- Check to see if you have enough money in your account to cover your online bills.

How To Get A myWisely Mastercard | Activatewisely.com activate card

If you want to obtain the payment card you want there are three methods. These are brief descriptions of each.

- You will receive a handover immediately. The employer can give you a card that is an instant issue – without fancy equipment, simply an actual card in the office.

- The card is delivered to you when you ride. could purchase a myWisely account for delivery to the address you have provided so you will receive it during an excellent trip.

- It is possible to do this by yourself. You cannot be a participant in this process for the final choice. You can enroll to get the card yourself and then have it brought to your home via a car.

Your debit card within one week of enrolment; remember that you should only count working days.

Some Frequently Asked Questions – FAQs

Why Should You Choose MyWisely?

It’s important to remember that there are a myriad of businesses that have credit cards, payment cards, and debit cards over the Internet. What is it that makes you stand out in comparison to other individuals?

Perhaps it’s the way you look, your abilities, or another aspect of your persona, isn’t it? Similar to a business, in order to be successful, it has to bring value to the possible clients. MyWisely is a great option to manage finances but it must have an excellent reason to do it.

There could be a huge question that’s running around in your mind. This isn’t the credit card you are using but it’s a debit card.

Why is that? There is no credit added to your credit card.

How Much Can You Withdraw At Once?

So far what amount can be pulled out from ATMs using myWisely cards is not known. We can however estimate it from the evidence we’ve uncovered. According to Forbes magazine suggests to its users that the ATM withdrawal limit is between $300 to $1000.

No matter what you need, we’re aware of how much cash you can receive from a teller who is available over the counter. If you add your myWisely credit card into your wallet or purse each day, you can get access to as much as 25,000 dollars per year.

What is the Reason Why My Card from Wisely is Declined every time I try to make a payment?

When you’ve reached your threshold for spending on your Wisely card, you are unable to be able to use it again to make cash. By using the myWisely application, you are able to review or alter your spending limit at any time.

Common Issues and Troubleshooting

Customers may face some typical problems during the activation of their card. The issue may be that the card has to be connected to an online account.

In order to resolve this problem, customers can sign in to their online account and then link the card using their 16-digit card number, expiration date, as well as CVV.

A different issue is that activation processes need to be successfully completed. In order to resolve this problem Users can dial the customer support line which is open all hours of the day or go online for help.

Customers may also face issues when using their credit cards like having difficulty in transferring cash or purchasing items. When this happens, users are encouraged to call customer service to seek assistance.

The Member Service can help with account-related questions, offshore payments, or national disputes, as well as travel warnings. It is essential to call customer service immediately if there’s a mistake in a transaction, or in the event that your card has been missing or stolen.

Conclusion

The card has many benefits for the card’s holders, for instance, the ability to perform transactions as well as withdraw cash from ATMs all over the world. The card allows you to settle your charges online, and also purchase online wherever Visa is recognized.

Inscribing and managing your card is an easy process that can be accomplished using the app the website or through customer support.

There is, however, the possibility of encountering several common difficulties when activating the card, like having difficulty connecting the account to an online account or finishing the activation process with success.

When this occurs, cardholders should contact the customer support department for help. In the end, this can be a secure and convenient alternative to paying for purchases that will help customers manage their finances swiftly and conveniently.